IR271 Working for Families Tax Credits 2019 / ir271-working-for-families-tax -credits-2019.pdf / PDF4PRO

T20-0090 - Earned Income Tax Credit; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2019 | Tax Policy Center

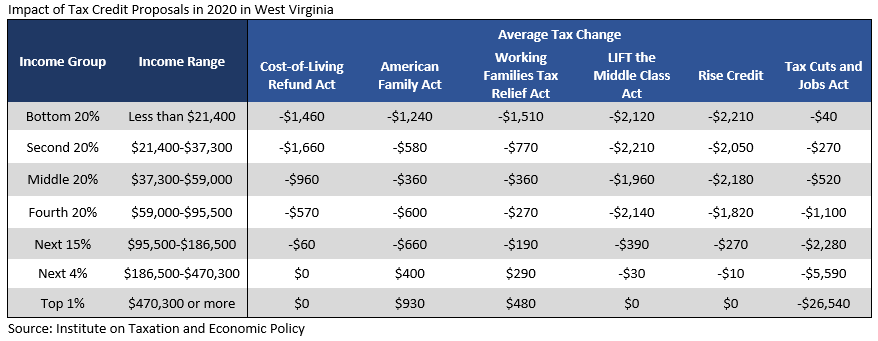

Five Major Federal Tax Credit Proposals and What They Would Mean for West Virginia - West Virginia Center on Budget & Policy

:max_bytes(150000):strip_icc()/107865238-F-56a938633df78cf772a4e308.jpg)